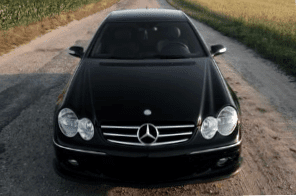

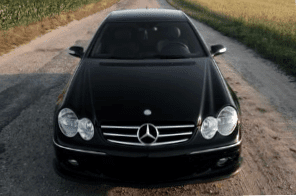

The matter of the heart Newtimerversicherung and Youngtimerversicherung. coverage for vehicles from 10 to 29 years.

What are newtimer and youngtimer?

Vehicles can be considered newtimers from 10 years of age. For us, youngtimers are vehicles that are at least 20 years old. These must correspond as far as possible to the original condition and be in a good state of preservation.

Some of our product highlights in the area of newtimer& Youngtimer

Our insurance solution for newtimer and youngtimer comes with some special features, among others:

- Everyday use is insurable (for youngtimers).

- No everyday car is needed as a "first car".

- We can insure without mileage limitation (for youngtimers).

- Low mileage (z.B. 2.500 km/year) are possible to optimize premiums.

- A covered parking space is usually not mandatory.

- Policyholders are possible from 18 years of age.

- Accompanied driving from the age of 17 is also insured free of charge.

- Self-assessments are up to 130.000 EUR vehicle value possible.

- Free driving on race tracks (without racing character) is insurable.

- Vehicle conversions are insurable.

Development in Germany

There are currently over 8.6 million registered vehicles in Germany that are more than 15 years old. Around 600.000 vehicles in the youngtimer segment have classic car potential and around 7 million newtimers are in everyday use or of unclear status.

Why newtimer or youngtimer insurance??

As with newer automobiles, new and youngtimers must have at least third-party insurance to be allowed on German roads. Due to the above-average values of the vehicles, partial or fully comprehensive insurance or so-called "all-risk coverage" is recommended. Important to know: Not every vehicle of the appropriate age qualifies for coverage in a classic car insurance policy.

Generally, classic car insurance is usually cheaper than regular car insurance, as insurers assume that vehicle fans take extra care with their cars and tend to drive them more on special occasions. This reduces the risk of an accident for the provider and, consequently, the costs as well. In addition – and in our view most importantly – classic products are explicitly tailored to the needs of vehicles and vehicle owners and are best able to address the special features that the mobile treasures bring with them and convert them into tailored insurance cover.

You can calculate your insurance costs here and take out the insurance online. You will receive an eVB (electronic confirmation of insurance) afterwards.

Where are the differences with the classic car?

The age of the vehicles makes the difference. Cars over 30 years old can be registered as classic cars. If the vehicle is in good, largely original condition, it can be presented to an expert who will carry out the inspection. If this runs positively, the vehicle is recognized as an automotive cultural asset and receives an H license plate. Vehicles with H license plates may z.B. Driving in low emission zones without an additional sticker. In addition, there is a flat vehicle tax of 192 euros per year for these vehicles. There is no fixed definition for youngtimers, nor is there an H license plate or a flat rate for vehicle tax.